Sino Partners welcomes improving market conditions in 2025.

Welcome to 2025.

As we step into 2025, Sino Partners extends warm greetings to our clients, partners, and stakeholders.

The new year brings with it a sense of optimism and opportunity in the construction machinery sector, a key driver of development in the Oceania region. As SP is dedicated to supporting Chinese construction machinery OEMs entering the Australian market, we look forward to a year of innovation, growth, and collaboration.

2025 Construction Machinery Market Trends

The global construction machinery market is forecasted to grow at a compound annual growth rate of 6.1%, reaching an estimated valuation of USD 250 billion by the end of the year. In 2025, technological innovation and sustainability are set to dominate. The push for electric and hybrid construction machinery continues to gain momentum in Oceania, driven by stricter environmental regulations and growing demand for energy-efficient solutions. Market leaders are expected to introduce advanced models featuring improved battery life, rapid charging capabilities, and enhanced performance metrics, making these machines viable alternatives to traditional diesel-powered equipment.

Another trend is the integration of smart technologies in machinery. IoT-enabled equipment, real-time diagnostics, and predictive maintenance systems are becoming standard, allowing for better operational efficiency and reduced downtime. Additionally, the increasing use of automation and autonomous machinery will further reshape the industry, offering cost-saving opportunities and addressing labor shortages in construction-heavy economies.

Economic Overview in Oceania

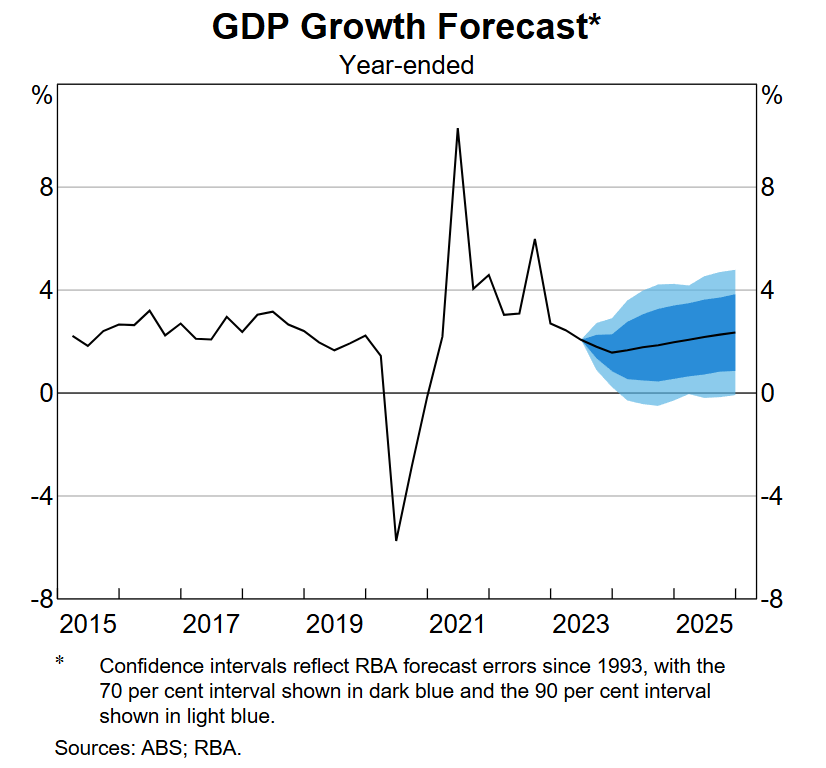

The Oceania economy is projected to grow at a steady pace, with Australia leading the region with an expected GDP growth of 2.8% in 2025. Key infrastructure projects, such as the Sydney Metro West expansion and renewable energy developments, will fuel demand for construction equipment. New Zealand, with its robust housing and infrastructure pipeline, is also poised to contribute significantly to regional growth after a couple of challenging years of market activity.

However, some challenges may impact the pace of growth. Rising interest rates, higher borrowing costs, and inflationary pressures could potentially dampen investment in large-scale projects. Additionally, ongoing global supply chain disruptions will pose challenges for machinery imports and distribution, requiring strategic planning to mitigate delays and manage costs effectively.

Relatively soft outlook for GDP growth in the near term.

Opportunities for Chinese OEMs

Chinese construction machinery OEMs are well-positioned to capture market share in the Oceania region. With competitive pricing, advancements in product quality, and a growing portfolio of sustainable solutions, these manufacturers can cater to the evolving needs of contractors and developers. Establishing robust dealer networks, ensuring after-sales support, and adapting machinery to meet local specifications will be crucial for success in this dynamic market.

Prospects for 2025 suggest a cautiously optimistic recovery, driven by several supportive factors.

Partnering for Success

As Sino Partners embarks on another year of partnership and innovation, we remain committed to delivering value-driven strategies that enable our clients to thrive in the Oceania construction machinery market. Together, let us make 2025 a year of progress, sustainability, and mutual growth. Happy New Year from all of us at Sino Partners!

At Sino Partners. your success is our success.